Additional Capabilities

Retirement Plans

On-Site Qualified Plan, Case Design and Vendor Selection

The Retirement Plan Division, comprised of the Investment Services and Plan Administration departments, was founded in 1987 to provide investment, administration, and plan design services to pension, profit sharing, and 401(k) qualified plans. We are dedicated to helping your clients implement and maintain retirement plans that meet corporate goals and objectives; moreover, while they are focused on running their business, our Division is focused on servicing their plan for financial success.

Averaging over 20 years of industry experience, our in-house Third Party Administration department currently administers over 250 plans across the country. When choosing our team of professionals, your client will receive first-rate personal service at competitive prices in the oversight and administration of their retirement plan.

We handle each and every detail of the administration while providing excellent customer service; assisting with participant inquiries; and acting as the liason between record keeper, plan sponsor and advisor. Our clients range in size from sole proprietorships to corporations with over a thousand employees. The Plan Administration department provides a level of service commensurate with our clients’ needs.

Investments & Administration

Turnkey Plan Administration Capabilities

The Retirement Plan Division, comprised of the Investment Services and Plan Administration departments, was founded in 1987 to provide investment, administration, and plan design services to pension, profit sharing, and 401(k) qualified plans. We are dedicated to helping your clients implement and maintain retirement plans that meet corporate goals and objectives; moreover, while they are focused on running their business, our Division is focused on servicing their plan for financial success.

Averaging over 20 years of industry experience, our in-house Third Party Administration department currently administers over 250 plans across the country. When choosing our team of professionals, your client will receive first-rate personal service at competitive prices in the oversight and administration of their retirement plan.

We handle each and every detail of the administration while providing excellent customer service; assisting with participant inquiries; and acting as the liason between record keeper, plan sponsor and advisor. Our clients range in size from sole proprietorships to corporations with over a thousand employees. The Plan Administration department provides a level of service commensurate with our clients’ needs.

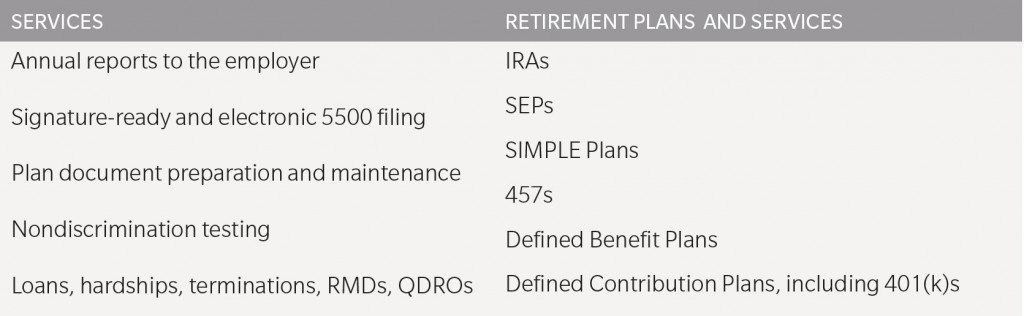

Services Provided:

Tax & Accounting Consultation

On-Site Tax and Accounting Resources and Expertise

AFG’s Tax and Accounting practice is distinct in its specialization and focus on many service-based and manufacturing industries, with a niche tailored to medical practices. A significant number of veterinarians, physicians, chiropractors and other medical professionals rely on Duncan Advisor Resources for accounting, payroll and tax advice, through the life cycle of their businesses.

We have unique and strong relationships with various medical associations and boards, and, thus, work personally with many of these members to drive efficiencies in the financial aspects of operating a sound practice. We work specifically with a large number of chiropractors and are the only full-service tax and accounting practice that is a member of the Pennsylvania Chiropractic Association. Proudly, our partners speak twice a year to graduating chiropractors to offer guidance on the initial set-up and tax structure of a practice, as well as ongoing communication related to prudent accounting and tax processes.

The partnership with our clients is year-round; we meet quarterly with most clients to help offer advice on an ongoing basis, not just for a single tax season. This is a significant benefit to many of our clients who can better plan for tax events and overall cash flow on an annual basis—instead of being surprised at one given point in a year.

Our expertise extends through company and individual tax returns, wealth preservation and management, and personal investments; as well as crossing over into personal and commercial lines of credit. Our reputation and hands-on approach benefits the advisors of Duncan Advisor Resources who count on our professionalism and support in helping their clients.

Our two senior partners have a collective 35+ years of experience and look forward to working with you.

♦ DRIVEN BY MUTUAL SUCCESS ♦ INDEPENDENCE WITHOUT ISOLATION ♦ EXPERIENCE NOT THEORY