Update:

NY Regulation 187

What you need to know

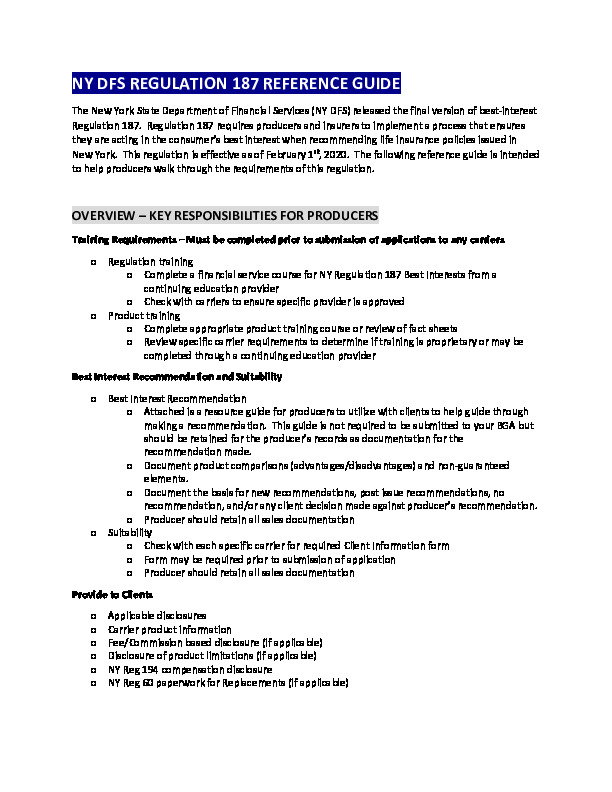

The New York Department of Financial Services (NY DFS) has released the final version of best interest Regulation 187. Regulation 187 requires producers to implement a process that ensures they are acting in the consumer’s best interest when recommending life insurance policies issued in New York. This regulation went into effect on February 1st.

Best Practices Before Selling Life Insurance in New York:

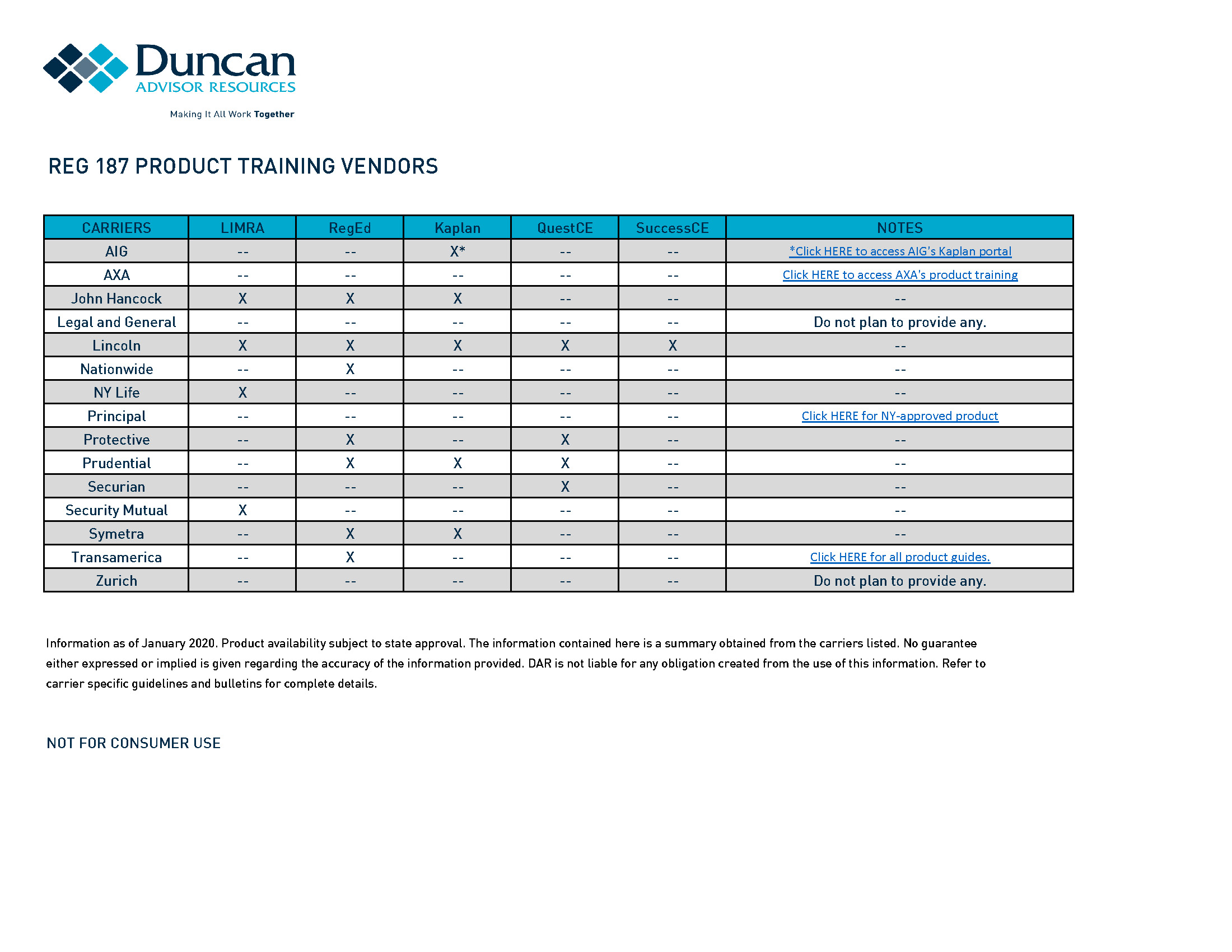

1. Complete a financial services course for NY Regulation 187 Best Interests from a continuing webinars provider prior to soliciting life insurance in New York.

2. Use the Custom Coverage tool below to help determine which product is right for your client based on their needs and to assist with the completion of all necessary carrier suitability forms at the time of application.

3. Contact our internal sales team for assistance with product and carrier selection, and to secure all necessary application forms.

4. Prior to taking an application, email contracting@duncanar.com to confirm your appointment and training status with the carrier. Training specific to each carrier and product is required in addition to the state training.

Contact your dedicated brokerage team with any questions.

Below you will find links to resources that provide additional information regarding the regulation and provide tools to assist you with training and implementation.